Participatory Capitalism

At a distance, capitalism is a marvel. Without planning, innovation thrives, competition lowers prices, and resources flow to where they’re needed. But zoom in, and you’ll see cracks. For many individuals, capitalism is failing.

Many Americans are trapped, living paycheck to paycheck, with wages that hardly reflect the wealth they generate for their employers. They trade their time for money, a poor exchange when that money barely covers the basics.

Meanwhile, those directly engaged with capitalism—entrepreneurs, investors, and business owners—reap far greater rewards. They earn based on what they sell, not the hours they work. Their income grows passively, making them wealthy and free.

Yet employees, the backbone of the economy, are cut off from the buying and selling that creates independence and builds wealth. Most workers don’t realize what they’re giving up. Starting a business feels too risky, so they choose the stability of a steady job over the uncertainty of the free market. They trade 40 hours a week for enough to cover rent, food, and maybe some savings.

What if employees had more options? What if they could choose something in between these two extremes?

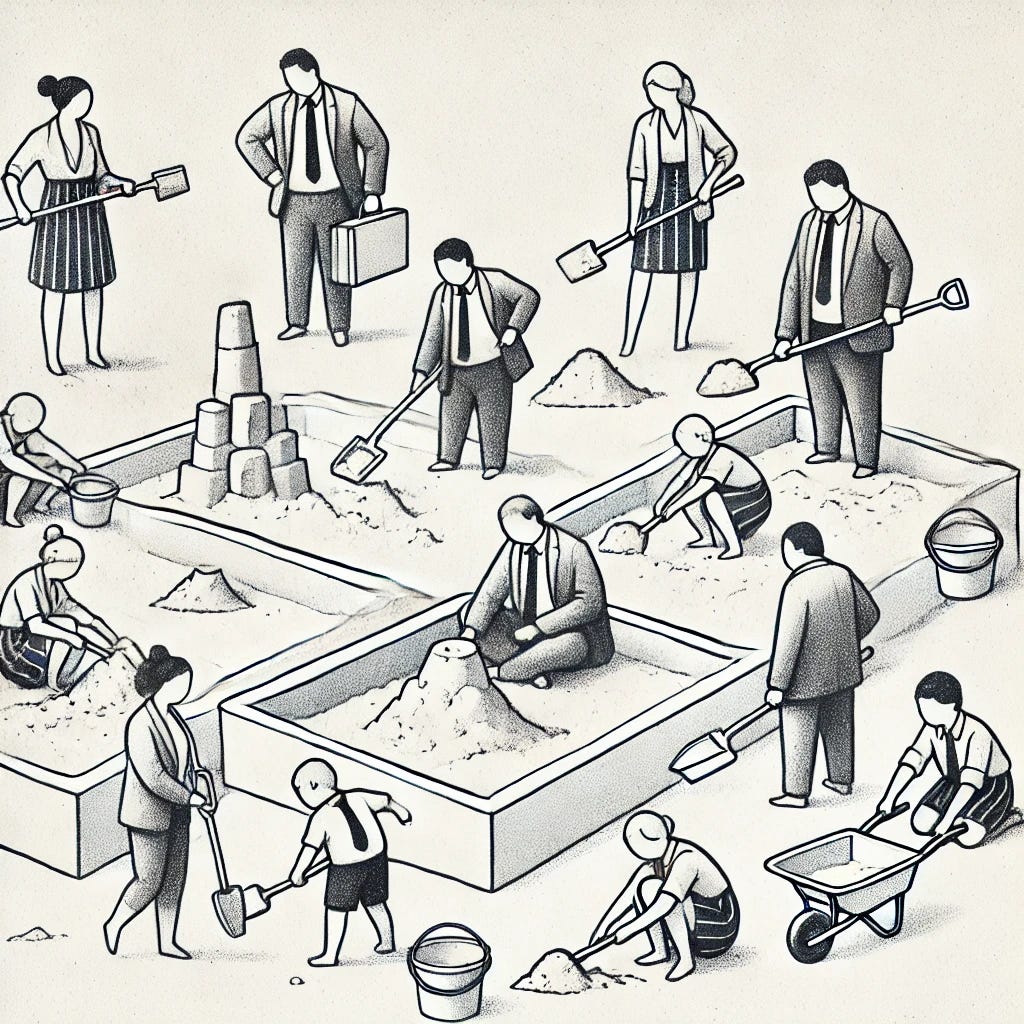

I propose an economic structure that uses incorporation to form capitalistic sandboxes—a fractal-like economy that mimics free-market dynamics also within organizations.

These sandboxes could lessen the hardships of bootstrapping a business while still tying compensation to market outcomes. Workers wouldn’t have to brave the harsh conditions of going it alone in the free market, but they could still gain economic freedom through entrepreneurial activity.1

The Market as a Network

A free markets is a web of interacting nodes. Some nodes are organizations—anything from mega-corporations to sole proprietorships to non-profits. Others are individuals, buying and selling goods and services.

But when you think about it, every corporation has a micro-economy of its own: it manages money, resources, and labor. It makes investments for the future. It could, in theory, use the same free-market strategies as the broader economy. Companies could operate like networks of teams and individuals, mirroring how economies link corporations and individuals.

But this is far from our current reality.

Most companies function as hierarchies: executives reap the rewards while workers shoulder the load. These structures mimic dictatorships more than free markets. Equity, when shared at all, rarely trickles down beyond a few layers. Most workers are cut off from the broader market.

Corporate activities can run efficiently without central planning—just as free markets don’t need centralized control to thrive. Most excitingly, corporations could share wealth with employees based on production—rewarding those who contribute directly to success.

Conceivably, some amount of corporate profit could be used inside the sandbox to pay a base living amount to employees as well as invest in their new ventures. This model would lower the barrier to market participation. A lighter weight entrepreneurship—not as risky as going solo, but offering a better upside than the status quo—a trade many would gladly make.

A Better Gauge of Healthy Capitalism

Big businesses and the jobs they create get a lot of attention. Cities and states bend over backward to attract companies willing to settle in their area. But this focus is shortsighted.

Jobs are important, sure, but jobs where people simply rent out their time only reinforce the unhealthy cycle of non-participatory capitalism. A better goal is to attract businesses that create the most employee-owners. The impact on the local economy is far greater. In fact, you could measure the health of a capitalist society by the percentage of people directly participating in the free market. A healthy capitalist society has fewer wage slaves and more active participants in the market.

The same misplaced enthusiasm applies to unicorn startups—companies valued at $1 billion. But the unicorn truly worth chasing is a billion-dollar company that creates a thousand millionaires. The societal impact of such a company would dwarf that of a handful of hyper-wealthy founders. A healthy capitalism should aim for these bigger, more meaningful goals.

Voluntary Change

Imagine a future where businesses naturally empower their employees to act as owners. No laws or mandates—just a shift in what workers expect and demand.

Entrepreneurs would need to resist the lure of profits and instead embrace equitable, self-managed systems. If enough companies took the leap, employee-owned and managed businesses could become the norm. What worker wouldn’t prefer this way of working? Business owners who refuse may find themselves working alone, unable to attract talent.

Self-managed organizations are already making waves, especially outside the U.S. For examples, check out the Corporate Rebel’s bucket list. What once seemed impractical has now proven viable in hundreds, if not thousands, of companies.

Conclusion

Capitalism has delivered great prosperity, though unevenly. Let’s not dismantle it out of frustration. Let’s fix it—so everyone can have a fair share in its rewards. By supporting businesses that prioritize employee ownership and demanding more equitable systems, we can make capitalism work for all of us.

Gary Hamel and Michele Zanini make a similar argument in their excellent article: https://fortune.com/2020/11/21/capitalism-entrepreneurship-economic-inequality-us-bureaucracy/